TRUMP SOPHOMORE YEAR ECONOMIC REPORT CARD

Introduction

This year I am putting all measures in the same units: percentages. Most are annual percentage changes (or growth rates) in the particular economic measure. Two exceptions are deficits and unemployment rate as will be explained in those sections. If a particular economic measure starts very high (or low) at the beginning of the year it is more likely to hit record highs (or lows) during the remainder of the year. How much it changes during the year is a better measure of how economic policies worked during the year. The same measures are shown for the years 2010 through 2017 for comparison.

Earnings

Figure 1 shows average weekly earnings growth[1] for all private employees.

FIGURE 1

This measure subsumes both wages and hours worked. It can be seen from the graph that 2018 was better than 2016 or 2017, but not as good as 2011, 13, 14, or 15. It was very close to the results of 2012. Another way of putting it is that 2018 was pretty close to average for the period considered.

Deficit

The budget deficit won’t be known precisely until all tax returns are in in April. Here I will just note that the estimated deficit for 2018 has not changed since last April. However, with the government shutdown I don’t know if there has been any attempt to update that estimate.

For this measure I don’t show annual changes but just deficits as a percentage of GDP. Figure 2 shows the numbers[2] as of April 2018.

FIGURE 2

The upward trend is ominous. I will send an addendum if the April 2018 number are significantly different.

GDP

Growth of Gross Domestic Product was good in 2018, as shown In Figure 3[3].

FIGURE 3

BEA calls this “real” GDP growth, which I presume means that inflation is taken into account. The growth in 2018 was exactly the same as in 2015, but better than any other year of the nine.

Inflation

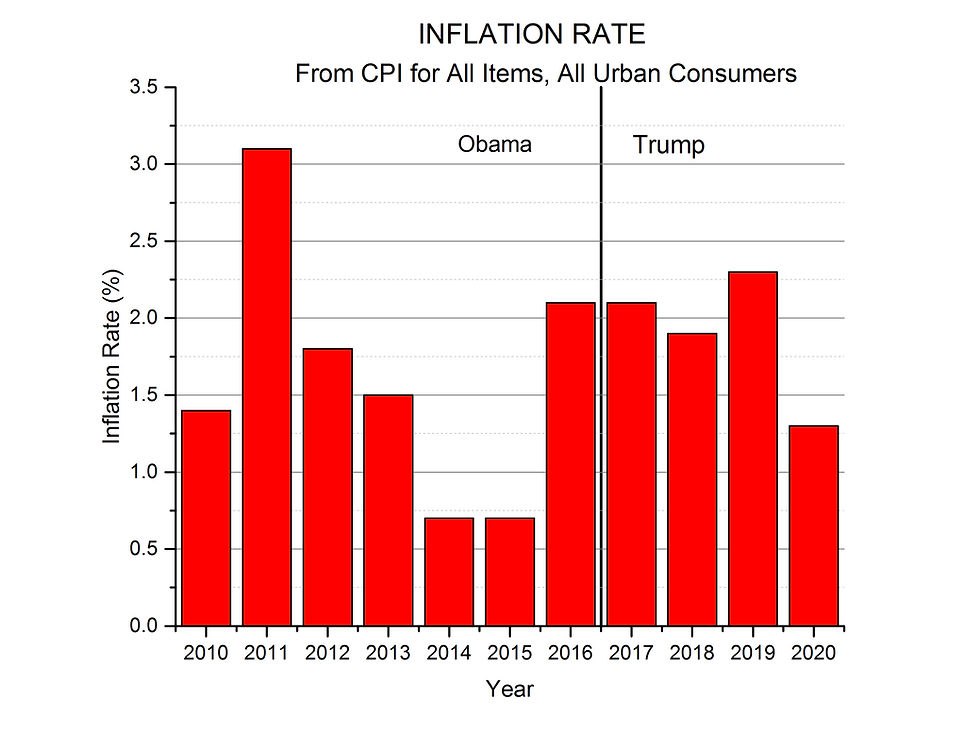

The inflation rate is the percent change in the Consumer Price Index (CPI). It has been very low ever since The Great Bush Recession. That has not changed throughout the whole Obama administration or the first two years of the Trump administration[4]. Figure 4 illustrates.

The Federal Reserve prefers a target rate of around 2%. 2018 was excellent by that standard, but not much different from 2012, 16, 17.

FIGURE 4

Jobs

Job growth improved from Trump’s freshman year. It is shown in Figure 5[5]. The 2018 results are fairly average for the nine year period, with four years better (2011,13,14,15), three years worse (2010,16,17), and one year (2012) essentially the same.

FIGURE 5

Stocks

Stock market performance is tracked by several different indices. The most well-known are the Dow-Jones Industrial Average (DJIA) and the Standard and Poor’s 500 (S&P 500). The DJIA uses a sample of 30 large, publicly owned companies based in the U.S. The S&P 500 is based on the stocks of 500 U.S. companies. Here I use the S&P 500 index because it is more broadly based.

There are two possible ways to calculate stock market return: price return and total return. The former only measures change in the price of the sample stocks over the year, while the latter takes into account dividends earned also. Total return[6] is always larger than price return[7]. Both are shown in Figure 6.

It is easy to see that 2018 was the worst year for the stock market of all nine years shown. In fact it was the worst since the Great Bush Recession year of 2008, worse than any year during the whole Obama administration (2009 showed a sharp stock market rebound from the recession to over 26% price return). 2018 had the worst December performance since the Great Depression.

FIGURE 6

The poor market performance is of immediate concern to the 52% of families[8] with money invested in some form in the stock market. However, there is solid statistical evidence that annual stock market returns have an effect on both GDP growth and job growth in the following year. The evidence is in the form of significant, positive correlations: 62% correlation for GDP growth and 53% for job growth. This is a concern, or should be, to all Americans.

Although he was ready to take credit for good stock market performance, President Trump blames the 2018 collapse on the Federal Reserve interest rate increases during the year. The trouble with that reasoning is that there is zero correlation between the effective annual federal funds rate and the annual stock market return over the 60 year period 1955 – 2014. Since stock market return can change on every trading day and the federal funds rate can change several times a year, I investigated the quarterly figures for both. Using this data (240 data points) I found a small negative correlation[9], but the federal funds rate can only account for 2%, at most, of the variation in market return; at least 98% of the variation must be due to other factors. Good candidates for other factors in the December market collapse are Trump’s “easy to win” trade wars.

Unemployment

Unemployment rate is the other measure that is not an annual change. Rather it is the fraction of the labor force that is unemployed. As such it is responsive to changes in both the number of jobs and the size of the labor force (the latter generally increases every year). The unemployment rate remained extraordinarily low for all of 2018. The annual rates shown in Figure 7 are the averages of the monthly figures[10] for the year.

FIGURE 7

The unemployment rate is at a near record low, and is the star economic measure of the Trump administration so far. The graph vividly illustrates the steady, almost linear, decline from the highs of The Great Bush Recession. Economists often consider 5% unemployment rate as marking “full employment”. We have been at or below that rate since late in 2015.

Summary

2018 grades are with respect to the nine year period of the figures.

Are We Great Again Yet?

A quick review of Figures 1 – 7 convinces me that 2018 was about as great as Obama’s second term (2013-2016). But the reader, armed with the data, may decide for himself or herself.

Gary Waldman

March 2019

[1] Data from U.S. Bureau of Labor Statistics: www.bls.gov – series report CES0500000012

[2] Office of Management and Budget: www.whitehouse.gov/omb. Search for Historical Tables and go to Table 1.3.

[3] Data from Bureau of Economic Analysis National Income and Product Account (NIPA) Table 1.1.1 – www.bea.gov

[4] Data from www.bls.gov – series report CUSR0000SA0

[5] Data from www.bls.gov –series report CES0500000001

[6] Data from www.ycharts.com/indicators/sandp_500_total_return_annual-72k

[7] Data from www.macrotrends.net/2526/sp-500-historical-annual-market-returns--96k

[8] Federal Reserve Bulletin, September 2017, vol 103, no. 3

[9] I would be glad to send the scatterplot with regression line to anyone foolish enough to request it.

[10] www.bls.gov – series report LNS14000000

TRUMP JUNIOR YEAR ECONOMIC REPORT CARD

Introduction

These report cards are meant to give a true picture of U.S. economic activity during the Trump administration. I feel they are a needed dose of reality because Trump and his supporters have a tendency toward, to put it delicately, exaggeration.

Deficit

The deficit for 2018 (-3.8% of GDP) has come in a little lower than last January’s estimate (-4.1%), however the estimate for 2019 has gone up to -5.1% of GDP. The final 2019 result will not be fully known until all taxes are collected in April of 2020. Figure 1 shows all deficits since 2010[1].

FIGURE 1

Deficits have been increasing monotonically for Trump’s three years in office. All three years have larger deficits than any of Obama’s last three years. Tax cuts have a price.

Earnings

Here I must apologize to any readers of last year’s economic report[2]. I cannot reproduce those numbers shown in Figure 1 of that report; either I was looking at the wrong table or I made a mistake in calculation. Now I just rely on the Bureau of Labor Statistics option of showing the 12-month percentage change in any data. I take the 12-month percentage change in December for the growth in that year. Although the 2010-2018 numbers are much changed, the general conclusion that 2018 earnings growth was pretty average for the period remains the same. Figure 2 shows average weekly earnings growth[3] for all private employees 2010 to 2019.

FIGURE 2

This measure subsumes both wages and hours worked, which is important because many poor people toil at part-time jobs, or multiple such jobs. Several features of Figure 2 stand out. There are two years of zero growth (the bars aren’t missing in 2013 and 2019, just zero height) and one with negative growth. 2019 was one of the zeroes. The first two years of the Trump administration looked promising for earnings growth, but 2019 is poor.

Another way to look at wages is in terms of growth of disposable personal income. Disposable personal income (or DPI) is the income left to an earner after all taxes (federal, state, and local) are paid. This measure is tracked by the U.S. Bureau of Economic Analysis, using 2012$ to remove the effect of inflation. Figure 3 shows this measure for the 10 years[4].

FIGURE 3

In 2019 disposable personal income growth was average: four years better and five worse (including one negative growth year). One of the better years was last year. The jump upward in 2018 may be partially due to the tax cut, since average weekly earnings growth for 2018 was only fourth highest.

GDP

Growth of gross domestic product was fair in 2019, as shown In Figure 4[5]. Five of the ten years had better growth (including the first two Trump years) and four had worse. That makes 2019 about average.

FIGURE 4

Inflation

Still low[6] as Figure 5 illustrates.

FIGURE 5

Jobs

The job growth rate in 2019 was poor. 2017 and 2018 were pretty good, but 2019 had the worst job growth rate since 2010, as can be seen in Figure 6[7]. I should note that the BLS adjusts its numbers year-to-year, so the value for 2019 may undergo some small changes as time marches on.

FIGURE 6

Beware! I have noticed that many Trump supporters have been trumpeting “over 7 million jobs created since Trump took office.” That is false according to the U.S Bureau of Labor Statistics. In December of 2016 there were 123,129,000 persons employed in the private sector (BLS data is to the nearest thousand), while in December 2019 there were 129,737,000 so employed. That is a gain of 6,608,000 jobs, not “over 7 million”. Even if we throw in the increase in government jobs (federal, state, and local) the total increase is still below 7 million. For comparison, in the last three years of the Obama administration (Dec. 2013 to Dec. 2016) there were 7,559,000 private sector jobs created, according to the same database. Repetition of a lie will not magically transform it into truth. If you encounter someone propagating this falsehood, ask for the data source.

Stocks

Here I use the S&P 500 index as the measure, shown in Figure 7. 2019 was a very good year for the stock market. The return was second by only a little to 2013 in the ten-year period. As I noted in last year’s report, there is solid statistical evidence in the form of a statistically significant, positive correlation that annual stock market returns have an effect on both GDP growth and job growth in the following year. As if to illustrate, both GDP growth rate and job growth rate are down in 2019 after the bad stock market returns in 2018.

On the other hand, there is also statistical evidence that stock market return is a normally distributed, random variable[8]. Its rapid changes, as witness going from worst in 2018 to second best in 2019, are an indication of its random and unpredictable nature. Government policies play only a small part, if any. Still, it was great for my retirement accounts.

FIGURE 7

Unemployment

In unemployment, 2019 merits the same comments used in 2018. The unemployment rate remained extraordinarily low for all of 2019. The annual rates shown in Figure 78 are the averages of the monthly figures[9] for the year.

The unemployment rate is at a near record low, and is the star economic measure of the Trump administration so far. The graph vividly illustrates the steady, almost linear, decline from the highs of The Great Bush Recession. Economists often consider 5% unemployment rate as marking “full employment”. We have been at or below that rate since late in 2015.

No question in my mind that the unemployment rate measure is excellent and has been so for all three years of the Trump administration.

FIGURE 8

Summary

2019 grades are with respect to the ten year period 2010 – 2019.

Are We Great Again Yet?

I do not know of any single measure that specifies economic “greatness”. GDP growth rate may be the closest thing to such a measure. However we can average all the annual values for the 7 measures above over the last three years of the Obama administration (2014, 15, 16) and also the first three years of the Trump administration (2017, 18, 19) for comparison.

TABLE OF AVERAGE ANNUAL VALUES

For a “great” economy we would like the first and last of the measures, as well as inflation, to be low; the other four we would like to be high. The table shows an advantage for the Trump administration in the last two and for the Obama administration in the first two. The middle three are pretty close.

Gary Waldman

February 2020

[1] Data from Office of Management and Budget. www.whitehouse.gov/omb. Search for Historical Tables and go to Table 1.3, column K.

[2] Gary Waldman – Trump Sophomore Year Economic Report Card – The Liberal Hour, www.garywald.net, March 2019

[3] Data from U.S. Bureau of Labor Statistics: www.bls.gov – series report CES0500000012

[4] Data from Bureau of Economic Analysis National Income and Product Account (NIPA) Table 2.1, line 42 – www.bea.gov

[5] Ibid, Table 1.1.1

[6] Data from www.bls.gov – series report CUSR0000SA0

[7] Data from U.S. Bureau of Labor Statistics, www.bls.gov series report CES0500000001

[8] Gary Waldman – The Donald, the Mooch, and the Stock Market – Aug. 2019, www.garywald.net

[9] www.bls.gov – series report LNS14000000

TRUMP SENIOR YEAR ECONOMIC REPORT CARD

Introduction

Because of the pandemic, any administration would have had a less than stellar economic year, but I think the Trump administration’s inept handling of the pandemic made things worse. Not only did the U.S. have the most infections and deaths of any nation, but we also had more deaths per capita than 20 or so First World countries.

Trump promised 20 million vaccinations by the end of 2020, but there were only about one tenth of that number given. Trump blames the states for the discrepancy, but the federal government delivered fewer than 14 million doses to the states and gave them no help in vaccination programs. He did get in a lot of December golf, however.

.Deficit

The deficit for 2019 finally came in at 4.6% of GDP. The estimate for 2020 is higher (final figures are not known until after April). Figure 1 shows all deficits since 2010[1].

FIGURE 1

Deficits have increased monotonically for all four of Trump’s years in office. All four years have had larger deficits than any of Obama’s last three years. Republicans only seem to worry about deficits during a Democratic administration.

Earnings

This one is a surprise, with a large growth in 2020. I’m guessing it’s because so many of the jobs that were shed during the year (see sections on job growth and unemployment) were low-paying ones. That would increase the average earnings of the remainder; only full-time and part-time employed enter into this calculation. Also part-time workers who weren’t laid off (delivery drivers, grocery workers, etc.) might have got more hours during the pandemic.

FIGURE 2

GDP

Growth of gross domestic product was negative for 2020 Figure 3[2]: worst of the 11 year period, and the only negative growth since 2009, the end of the Great Bush Recession.

FIGURE 3

Inflation

Still low[3] as Figure 4 illustrates. One would expect low inflation in a poor economy. The low interest rate and easy money policy of the Federal Reserve has not spurred inflation as many conservatives thought.

FIGURE 4

Jobs

Job growth rate has generally been slow throughout the Trump administration, but 2020 was disastrous, as shown in Figure 5. Also had the only negative growth since 2009.

FIGURE 5

Stocks

The stock market showed the greatest disconnect from the rest of the economy in 2020 than in any other of the 10 years included in this study. Stocks soared while other economic indicators tanked. Figure 6 shows stock market returns since 2010. 2020 was the fourth best year in the whole period. It was not the best in the period, but many new record highs were hit because the market started out the year high. Figure 6 shows both price return and total return.

FIGURE 6

Unemployment

For the annual unemployment rates for each year I have averaged the 12 monthly rates. Figure 7 shows the results. You can see that 2020 had the worst unemployment by this measure since 2012.

This is a bit unfair to Trump in 2020, because there were very high rates (over 10%) in April, May, June, and July, but the rates came down in the later months of the year. Still, the December 2020 unemployment rate was higher (6.7%) than any December since 2013.

FIGURE 7

Summary

Are We Great Again Yet?

As far as the economy goes, the answer is no.

Gary Waldman – 29 January 2021

Comments